The essential argument of the source paper is :

The Canadian government's decisions -

1917 to 1923 - to assume control of the Canadian Northern, Grand Trunk

Pacific, and Grand Trunk Railways ...

was not an event of economic necessity.

Rather, these were deliberate political decisions

which marked a change in Canada ... "Each of these incidents can best

be understood as an act of state-building, in which the Canadian

government first developed a capacity to take charge of the nation's

economic restructuring."

The Canadian Northern Railway

Pioneer Railway of the Northern Prairies

All levels of Canadian government supported the rapid expansion of

Canada's railway network from the mid-1890s onward.

The federal

government under Laurier, and local provincial and municipal

governments, furnished financial support and bond guarantees to

Mackenzie and Mann as their Canadian Northern Railway

provided the first competition to the CPR

transportation monopoly on the Prairies.

Sir Donald Mann and Sir William Mackenzie as they would appear around 1920 at the end of this saga.

Sir Donald Mann and Sir William Mackenzie as they would appear around 1920 at the end of this saga.

Older and greyer.

In 1903, Wilfrid Laurier promoted the western expansion of the Grand

Trunk as the Grand Trunk Pacific ... as well as the Canadian government's building of the National

Transcontinental to support Quebec's ambitions.

This development spurred Mackenzie

and Mann to rapidly expand their network in the east to protect their

status as a carrier of western grain, and as a competitive transcontinental railway.

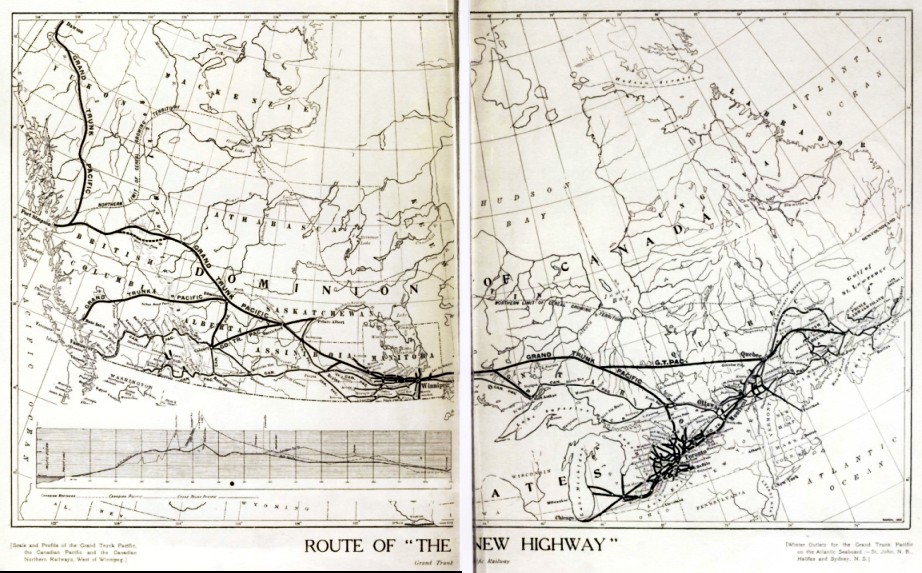

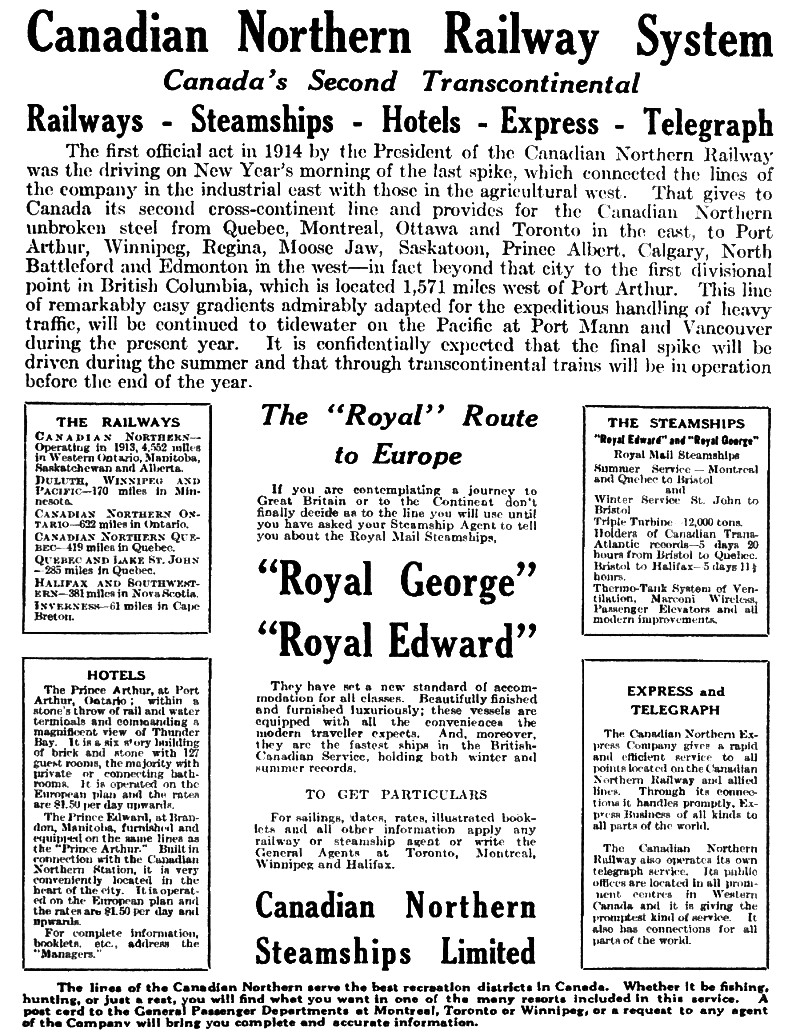

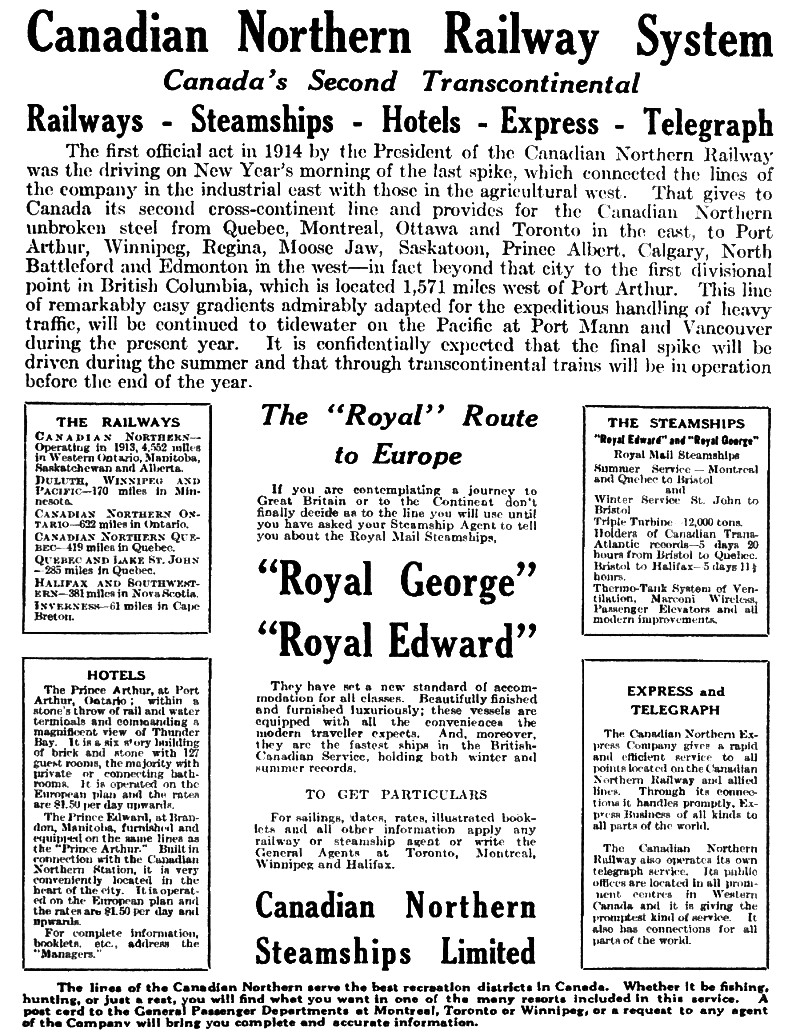

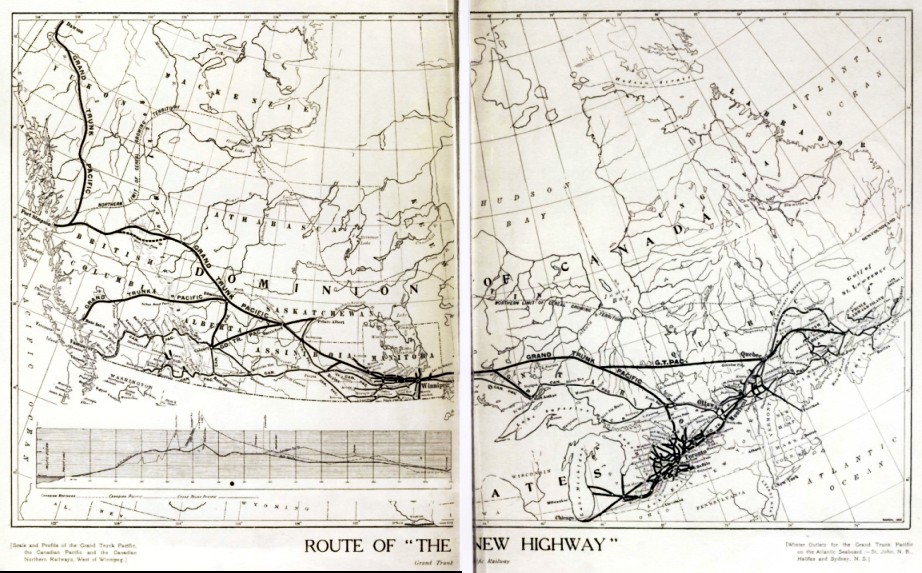

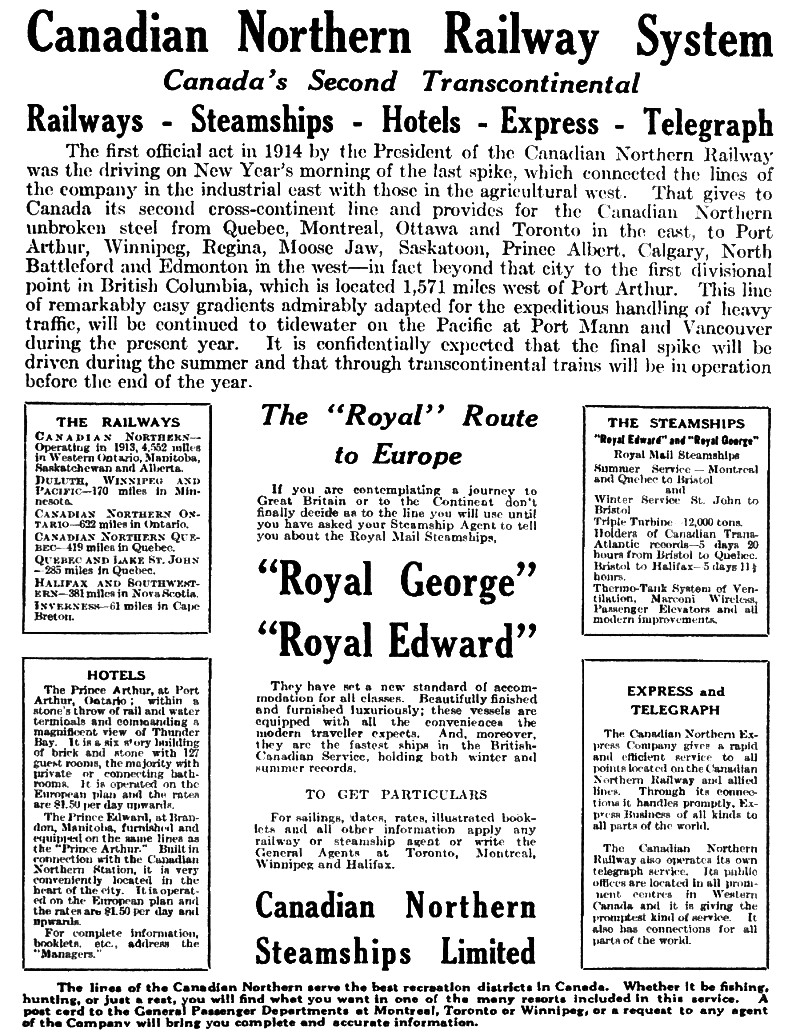

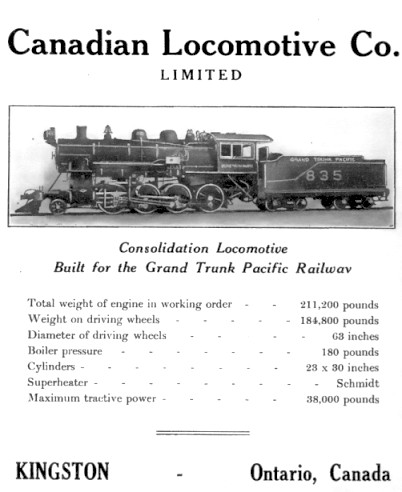

A 1904 promotional magazine spread of the projected Grand Trunk Empire ...

A 1904 promotional magazine spread of the projected Grand Trunk Empire ...

proposing TWO routes through the western mountains ...

a route to the Klondike ...

and probably double track to the moon as well.

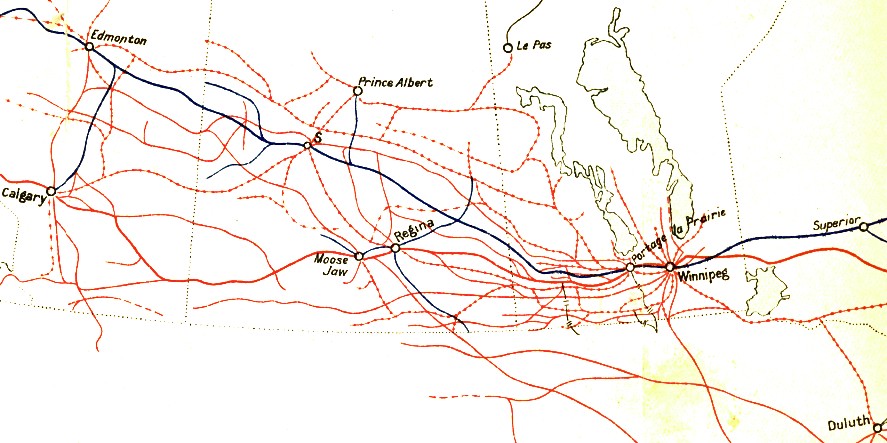

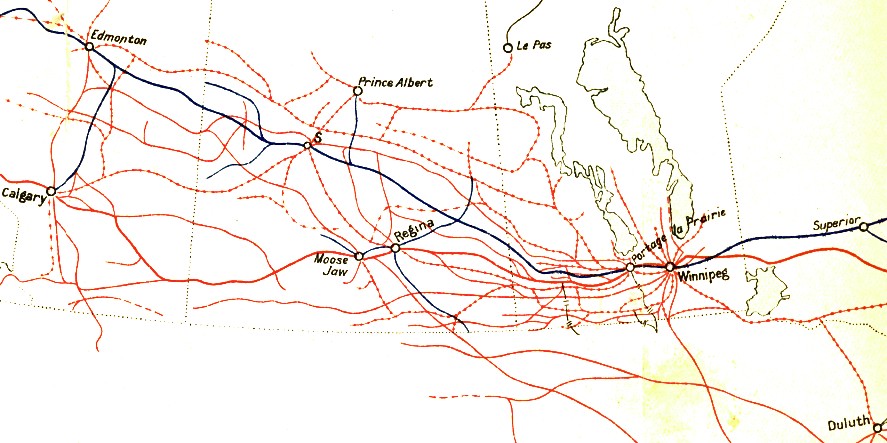

Reality in 1914.

Reality in 1914.

The Canadian Northern Prairie network is shown in red with cross-hatching.

The CPR system is shown as a smooth red line.

The interloping Grand Trunk Pacific is blue.

Broken lines indicate routes under construction.

Because

most Canadians and foreigners generally viewed railway expansion,

settlement, and putting the 'unproductive' grassland under the plow as

being "progress" ... there was little incentive for Laurier and the other

politicians to make themselves less popular by sketching their own futuristic 1914

maps and warning Canadians what such a network would ultimately cost the nation.

So the

spending continued without realistic limits because election victories

clearly indicated that the Laurier railway policies were well-supported

... at least that's how the victories were interpreted by Laurier.

The government changes : Laurier is out, Borden is in ...

along with the Canadian Bank of Commerce

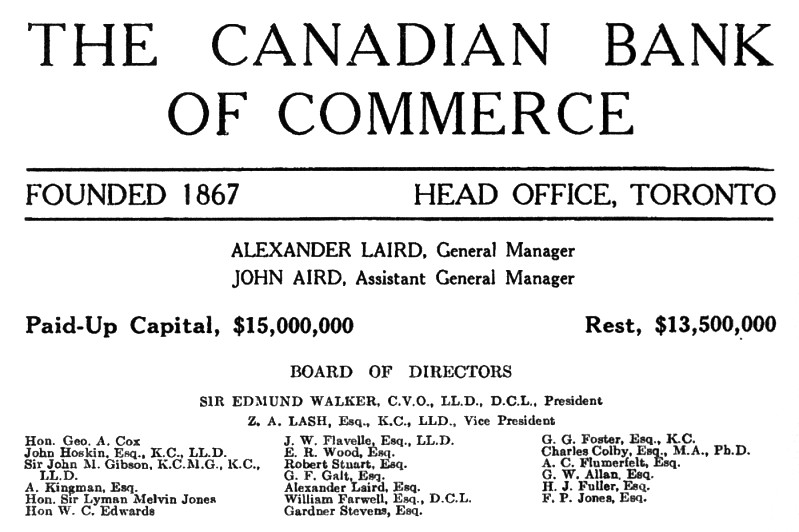

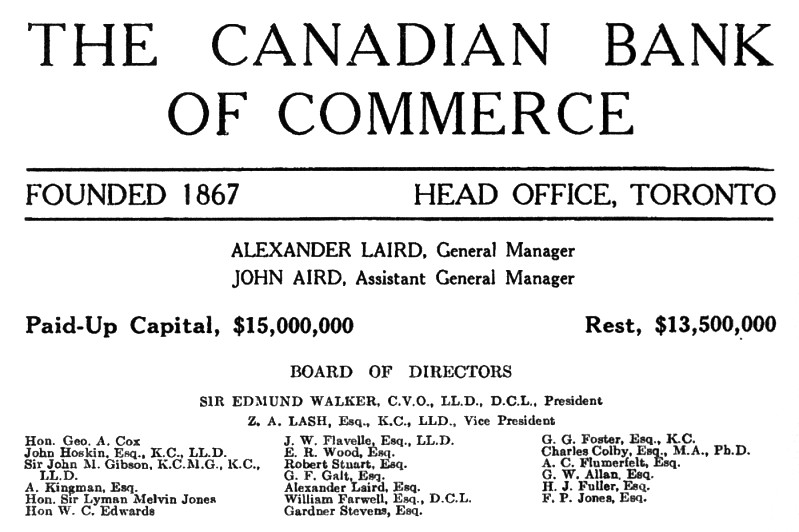

Beginning with Conservative Robert Borden's victory in 1911, the financial support for

railway expansion continued in the same vein for a while. Links between

the Canadian Bank of Commerce and the Borden government meant that this

bank could count on plenty of business in the railway financing field.

A magazine advertisement from 1914 for the Commerce.

Zebulon Lash was a

Toronto corporate lawyer ...

who was also known for drawing up the "seamless

contracts" used by the Canadian Northern Railway.

Edmund Walker back in 1902

Edmund Walker back in 1902

He literally wrote "the book" on Canadian banking.

Sir Thomas White joined the Borden government as finance minister

after resigning his position as vice president of the Bank of Commerce

and supported the Canadian Northern in his new government job. In the spring of

1913, he negotiated a $16 million grant to the Canadian Northern to help it meet its debt service obligations. In return, Mackenzie and Mann assigned $7 million of their equity stock

to the government.

Given the small origins and evolved corporate structure of

the CNoR ... Mackenzie and Mann still held the majority of the voting stock

personally.

This was the largest transfer of their equity up to this

point.

What is not known is whether White knew that the shares given to the government were already being used as collateral

for loans made by the Bank of Commerce. Walker and Laird

eventually told their board about their secret loans to the CNoR

- the total amount of money owed by Mackenzie and Mann to the Bank of Commerce now exceeded their remaining equity in the CNoR.

So the government and its friendly bank were tugging on opposite ends of the same block of Canadian Northern shares.

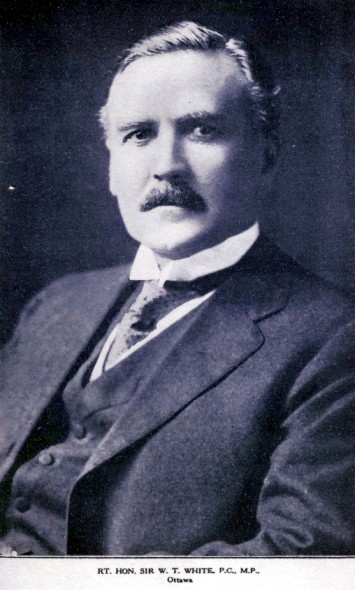

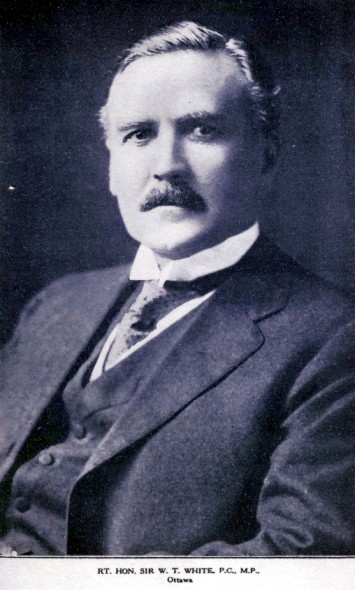

Sir Thomas White

Sir Thomas White

Without previous political experience ...

but with over a decade running financial institutions ...

his first job in government was Minister of Finance !

During the war, among other achievements,

he was responsible for the great success

of the Victory Loan campaigns.

Just before World War One diverted

foreign capital from Canadian railway expansion, the government

guaranteed $45 million in CNoR bonds in exchange for $33 million of CNoR

stock.

The $45 million was intended for use to finally complete the transcontinental line to the Pacific. This gave the government a 40% stake in the CNoR voting stock.

Instead of netting about $45 million from the sale of the bonds in

Britain ... only $15 million of the bonds had been sold when the war

started and controls were put in place to keep capital in Britain.

Mackenzie and Mann had given up $33 million of the their voting stock for a cash infusion of only $15 million.

In 1915, the government was toiling away to

finance its part of the first great industrialized war and to train its volunteer army. The Bank of Commerce was a

key Canadian financial institution.

[In 1913, the bank was the largest by

"assets", followed closely by the Bank of Montreal, then the Royal Bank

and 21 other smaller Canadian banks]

If the CNoR went bankrupt ... and Canada's largest bank lost the money lent to the railway due to insufficient collateral ... the economic and political fallout of "failure during a war"

would have at least caused damage to depositors'

confidence ... and damage to Canada's self-image and reputation within the Empire.

* * *

To enable the railway to survive through the winter of 1915-16,

in May 1915 Borden and some members of his cabinet gave the Bank of Commerce's Walker

a written assurance that the government would guarantee the

$6 million lent to CNoR that year ...

without telling Parliament of this promise.

* * *

In his letter Borden wrote:

"If the [CNoR] does not prove successful the government proposes to take over the Canadian Northern System;

and in that it will repay, or cause to be repaid to the Bank the said monies hitherto advanced to prevent default ..."

This was not good enough for the Commerce ... it demanded a formal lien on Mackenzie and Mann's remaining 60% equity in the railway.

The war had dragged on long past its giddily predicted end of Christmas 1914.

The endless series of blind brutal battles during 1916 suggested that Borden's secret

assurance to the Commerce was probably going to cause a crisis for him

before the war finally ended.

... And if you have read CNR - Part 1, you might already expect

that Laurier and the Liberals were not great supporters of all-out war

for the Empire ...

If Borden's secret dealings with the bank were exposed, he would lose control of his government.

Because of the lien, Mackenzie and Mann could lose control of their system to the Bank of Commerce.

However, the Bank of Commerce now had the necessary financial security to solve its collateral problem ...

AND information which could cause a significant political scandal.

In its own words in 1914

The Canadian Northern had become more than a

pokey little Prairie shortline with low rail joints, teakettle

locomotives, and wooden trestles.

Normally, in a railway bankruptcy ...

[my explanation]

- The bondholders launch legal a claim for their assets,

long after the value of their bonds has depreciated well

below face value in the market.

- The same kind of thing would happen to equipment trust

certificate holders ... and investors with similar claims on other tangible

assets.

- Having less safety from loss, junior debt issues including debentures might get a real haircut or be written off entirely.

- The common stock holders (the railway "owners") would be left with worthless certificates as the properties they had controlled were reorganized.

- The

immovable asset of the "rail way, its roadbed and its routing" would likely be more valuable as an

intact going concern ... than if it was simply seized and sold as

"parts".

- If

some lines or other assets were redundant or of low earning potential

... it would be better to scrap or dispose of them during the reorganization.

"Private sector medicine" for investors who bought into a railway "bubble".

However, in this case ...

- Borden and his ministers were up to their armchairs in alligators ... dealing with the

Conscription Crisis ... finding money to feed the War's insatiable maw

with soldiers and materiel ... and taxing the windfall profits of industries making products in demand for the war.

- The Bank of Commerce's principals had Borden's secret guarantee.

- The Bank had provided loans based on the value of CNoR shares which Borden could render either valuable or worthless.

- They

were occasionally reminding ("threatening" is such an ugly word) Borden ... in a quiet

gentlemanly manner, about their concern about the value of "their

shares".

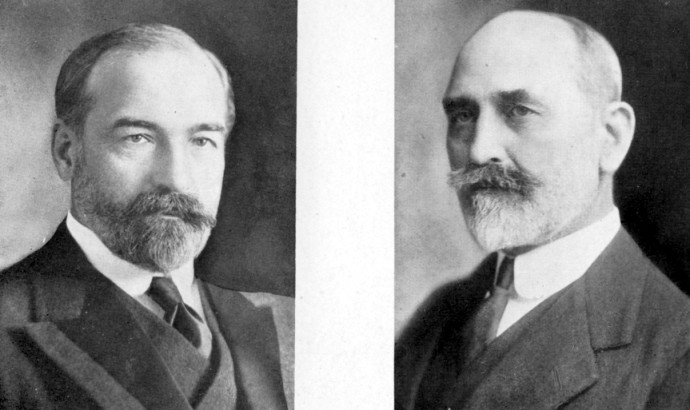

Sir Joseph Flavelle of the Commerce's Board

Sir Joseph Flavelle of the Commerce's Board

was personally doing very well

in the wartime pork and bacon packing business.

He was also being very "gentlemanly" with Borden and White

regarding the value of the Commerce's CNoR stock.

"Report on the Canadian Northern System 1917"

Mackenzie and Mann were busily 'shopping' their railway to : the CPR, US railroads, American financiers ...

fearing

they might be cut out entirely by the Bank of Commerce or the

government ... if and when their system was seized and reorganized.

To provide an arm's length valuation for "white knight" partners, they engaged :

E.J. Loomis

|

President, Lehigh Valley Railroad

|

J.W. Platten

|

U.S. Mortgage and Trust Company - a major railroad financier

|

Their verdict :

"We

are unanimously of the opinion, after many months' consideration of the

subject, that the undertaking as a whole is sound, and that the

soundness can be demonstrated at this time"

They

also underlined their opinion that the CNoR's northern prairie system would see faster

market growth than either the CPR or the Grand Trunk.They suggested it

would take $86 million to finish the mainline to the Pacific, and to

fund the deficits for their five year plan. This would involve PRIVATE

financing and not tax money.

A classic Canadian approach :

Got a problem ? Set up a Royal Commission !

Run their recommendations through Parliament.

It was Finance Minister White who wrote to Borden in January 1916 with these ideas ...

"What

I have in mind is that such a report might conceivably recommend the

amalgamation of the

Canadian Northern, the Grand Trunk, and the Grand

Trunk Pacific ...

into a system in which the Government might be interested to a certain

extent as shareholder with the present shareholders or security holders

...

Personally, I have come to the conclusion that it would be unwise to

deal with the Grand Trunk Pacific and the Canadian Northern one at a

time.

Nothing but a comprehensive measure will meet the situation."

... and the bank payout promised in writing by Borden to the Bank of

Commerce will hopefully get lost in the larger political shuffle.

"Royal Commission to Inquire into Railways and Transportation in Canada"

Spring 1916 to Summer 1917

Plot spoiler for intuitive people ...

Borden cabled from London to Ottawa in February 1917, two months before the final report was completed :

"SECRET ASK DRAYTON CONSULT WITH WHITE AND MEIGHEN RESPECTING RAILWAY REPORT"

The Commissioners

Name

|

Occupation

|

Commission Position

|

"Nationality"

|

Why Appointed ... Really

|

Alfred J. Smith

|

President,

New York Central Railway

|

Head of Commission

|

American

|

Provides US credibility for Commission.

Smith has a higher status than "Loomis" of CNoR's study.

|

William Acworth

|

Lecturer,

Railway Economics

London School of Economics

|

Commissioner ... after previous British candidate resigned account health.

|

British

|

Provides British credibility for the Commission.

Replacement on short notice.

|

Sir Henry Drayton

|

Lawyer,

Toronto (Conservative)

|

Commissioner

|

Canadian

|

Conservative.

Head of Board of Railway Commissioners - the Canadian railway regulator.

Experienced with establishment of Ontario publicly owned electric utilities.

Against high private owner profits from electricity and transportation operations.

|

Smith and Drayton held hearings on the Canadian Northern at Toronto,

and on the Grand Trunk and Grand Trunk Pacific at Montreal. By the time

Acworth was appointed and arrived in Canada, Smith and Drayton already developed their opposing views on the appropriate outcome.

Smith advocated allowing the railways to go into bankruptcy, and have a

bankruptcy trustee reorganize them. This would cause the railways'

securities' valuations to drop in value to reflect the actual earning

potential of the railway.

The head of the commission - Smith - wrote a dissenting minority opinion.

Drayton had a record of Board of Railway Commissioners decisions which placed economic stimulus ahead of profits. He was in favour of nationalization. Late arrival Acworth in later years said he sided with Drayton because during the War only the government had the money to refinance the railways.

As the government accepted the majority report of these two commissioners, the Royal Commission was subsequently referred to as "Drayton-Acworth".

["Bankruptcy and Refinancing Theory"

... If a company has money problems because its management has made

mistakes or simply had bad luck ... its total stock market value ('market cap' = $/share x Number of shares outstanding) might drop from

100% to 40%. Your $100 par value share is only worth $40 - a haircut. {Today's common shares don't have a "par value"}]

[In order to provide MORE money to FIX the company so it

CAN succeed, it must find a significant new source of money. Needless to say

... whoever it is ... THEY will be in a position to dictate WHO will manage

the company ... and WHAT other conditions they want in exchange for their money.

Maybe they will dictate your $40 share is only worth $20 before they

buy it ... or maybe you can keep your shares, but your "class" of

shares does not get to vote anymore on company business, giving the REFINANCER complete control.]

"Drayton-Acworth"

"These companies [CNoR, GTP, GT] have broken down. We see no way to

organize new companies to take their place. The only possible successor

is in our view a public authority. We are confronted with a condition

and not a theory."

Instead of using the "earning potential" of the railway, Drayton chose his

own interesting metric called "reproduction value" - what it would cost to

rebuild the Canadian Northern back in 1914.

The value of the railway was

calculated using this kind of formula ...

1914 railway asset value (before wartime inflation)

less wartime wear and tear (see CNR - Part 1 for 'railway problems during a war')

less 1916 liabilities (after wartime inflation and increased wartime operating costs)

omitting other valid assets ... such as cash on hand, and sinking funds for land grant bonds

... Equals the Drayton-Acworth conclusion about the CNoR ...

"shareholders ... have no equity

either on the ground of cash put in, or on the ground of physical

reproduction cost, or on the ground of the saleable value of their

property as a going concern. If ... the people of Canada have already

found, or assumed responsibility for, the bulk of the capital; if they

must needs find what further capital is required; and if they must make

up for some years to come considerable deficits in net earnings, it

seems logically to follow that the people of Canada should assume

control of the property."

The CNoR's Prince Arthur Hotel in Port Arthur circa 1912.

The Grand Trunk in "Drayton-Acworth" - it's better to be Canadian

The Grand Trunk's extensive eastern network is shown in red.

The Grand Trunk Pacific's liabilities were guaranteed equally by the Canadian government and the Grand Trunk.

Drayton-Acworth

stated these liabilities couldn't be met out of the Grand Trunk's current

[wartime] revenues ...

however the report didn't address the

possibility of the Grand Trunk raising cash by disposing of some assets.

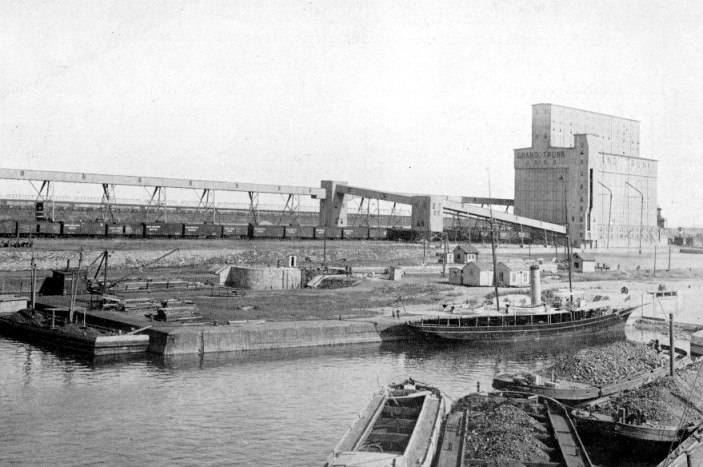

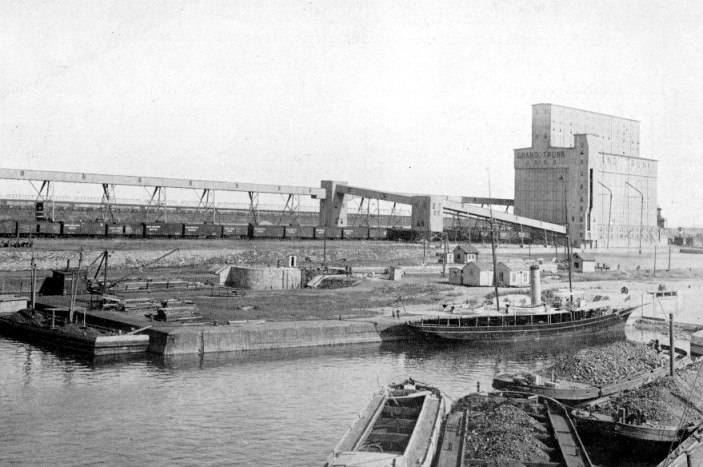

Circa 1910 a Grand Trunk grain elevator in Montreal with the Grand Trunk's Victoria Bridge in the distance.

Circa 1910 a Grand Trunk grain elevator in Montreal with the Grand Trunk's Victoria Bridge in the distance.

In addition, Drayton-Acworth drew upon the political issue of

Canada's sacrifices in World War One as Canadians participated in

Britain's war in Europe ...

Were Canadian and British interests the same?

What about the Grand Trunk Board and the British investors of the GTR

who only cared about squeezing the company for their dividends? ...

"

The Grand Trunk's Board of Directors

is 3,000 miles away. We cannot think that the state of affairs which

our investigation has disclosed could have arisen had the Board been on

the spot. We are forced to the conclusion that control of an important

Canadian company should be in Canada. But this cannot be secured as

long as the Grand Trunk Railway is owned by shareholders in England. We

have come to the conclusion, therefore, that the control, not only of

the Grand Trunk Pacific Company, but also of the Grand Trunk Company of

Canada should be surrendered into the hands of the people of Canada."

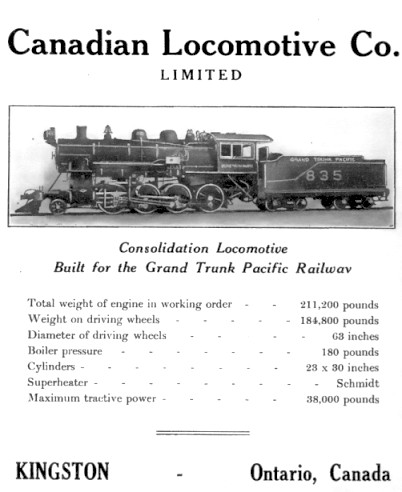

A 1914 builder's advertisement showing a new freight locomotive.

The private Canadian Northern is gone - winners and losers

Finance Minister Thomas White

was also acting Prime Minister ... during Borden's trips to Britain and the European

continent to attend to issues related to the War. White introduced

legislation to acquire CNoR's remaining stock from Mackenzie and Mann.

He also indicated that Drayton-Acworth

would be the foundation for future government policy.

An arbitration board

was set up to value Mackenzie and Mann's shares with an upper limit

fixed at $10 million ... what they were later paid roughly matched their

indebtedness to the Bank of Commerce.

That payment was made ...

the Bank of Commerce

loans were covered ...

and the potential of a scandal from Borden's

private guarantee to the bank was finally extinguished.

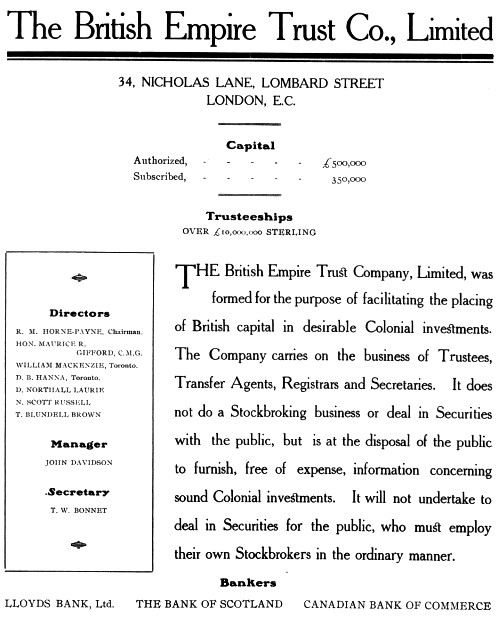

During earlier CNoR securities promotion, British Empire Trust and Lazard

Freres had been paid in CNoR stock. R.M. Horne-Payne [Have you seen that

name on a Canadian map?] of the former company wrote to Borden to suggest THEIR

shares were worth more - but he was ignored by Borden and White.

Winners: The Canadian Bank of Commerce - the government's preferred Canadian bank

Losers: CNoR shareholders : Mackenzie and Mann ; British Empire Trust ;

Lazard Freres [London, Paris, New York]

An advertisement for BETCO in 1909.

Note the list of directors ... at least 2 CNoR insiders.

And, for dramatic effect in the movie version ... an echoing voice

speaks these words - cabled by Borden before 'Drayton-Acworth' was completed

...

"SECRET ASK DRAYTON CONSULT WITH WHITE AND MEIGHEN RESPECTING RAILWAY REPORT"

The 'British' Grand Trunk is next to be Bordenized ...

Sir Robert Borden

Sir Robert Borden

Exhausted by the demands of the war he would retire in 1920.

As described in CNR - Part 1, Sir Robert Borden's actions during the War

changed the way Canada would relate to Britain in the future.

During the war, Britain was refusing to pay for exports from Canada, including food, resources and war materiel.

However, Britain expected Canada to pay ITS debts in cash, such as the guaranteed bonds of the Grand Trunk Pacific.

This demand had caused some hardship as Canada was already struggling to finance its war effort.

[And you'll recall the Grand Trunk Pacific was originally a project of : Laurier, the late Grand Trunk President Hays and approved by the British GTR Board ... none had been close friends of Borden]

Acworth [who seemed to contribute to the Royal Commission mainly by being British and

agreeing with Drayton] ... later wrote privately to White about the

Grand Trunk's corporate direction ...

"directors have

been paying dividends that were not earned and ought not to have been

paid ... I am very sorry for the Grand Trunk shareholders whose

directors have been culpably blind to fraudulent acts".

[After paying bondholders their legally required interest payments and completing scheduled bond series redemptions ... dividends are ONLY paid IF a surplus of net income is still available. If the money for dividends is not available ... preferred stock dividends

are 'passed' ... and therefore common stock dividends cannot

be declared ... The market then devalues the stocks as it sees fit

because the dividend income is not predictable. This usually reflects

quite poorly on management ... and they feel shame.]

Receiving Acworth's candid assessment probably didn't warm White's and Borden's hearts

to Britain and the Grand Trunk.

British newspapers criticized Borden

when it seemed his little Dominion might separate the railway from its Seat of Empire investors - big and small - and their money.

Proving the value of a Royal Commission yet again ... remember, a Briton was on the Commission ... Drayton-Acworth said ... "if

the Government is to relieve the Grand Trunk Company of its liabilities

which it voluntarily incurred but which it now finds impossible to

meet, it is for the Government, not the company, to fix the terms."

Grand Trunk President Smithers rejected the government's early offers to partially compensate the shareholders ... "it was inconceivable that a British dominion would refuse to honour [the full amount of] such obligations as preference shares."

... see what I mean ? He wanted all the guaranteed but never paid

dividends [so these were probably 'cumulative prefs'] on the three classes of

preferred stock plus a small dividend on the common stock.

In February 1919, to get the government's attention, the Grand Trunk suggested it just might default on a debt

obligation ... this didn't happen.

On March 10 the Grand Trunk indicated it would stop operations

on the Grand Trunk Pacific as it had insufficient cash.

Sir Thomas White was acting Prime Minister at this point ... as Borden was at the Versailles Peace Conference.

The next part is really cool ...

Using the War Measures Act White declared the Grand Trunk Pacific was essential to Canada's national interest ... put it under public receivership ... and under the Act, this decision could not be appealed by the Grand Trunk in the courts ... March 7, 1919.

He later cabled Smithers ...

"THE SHORT

NOTICE GIVEN OF INTENTION TO CLOSE DOWN GRAND TRUNK PACIFIC SYSTEM

WITHOUT PREVIOUS INTIMATION OR DISCUSSION FROM MONTREAL OR LONDON

SEEMED CLEARLY TO INDICATE INTENTION TO FORCE THE SITUATION AND HAS

BEEN SO UNDERSTOOD BY GOVERNMENT AND PARLIAMENT"

Rock and roll, Canada !

The Grand Trunk Arbitration

Once the War Measures Act had

been used to seize the Grand Trunk Pacific, the government was able to

protect Canadian railway jobs ... maintain service along the line ... AND call on the Grand Trunk's financial

guarantees to the GTP.

In October 1919, Legislation was passed through Parliament to acquire

all outstanding shares of the Grand Trunk Railway Company. An

arbitration board was to value these shares with a ceiling set at just

over $64 million. The Grand Trunk approved this arrangement. The

arbitration board was :

Board Chair : Sir Walter Cassels, justice of the Exchequer Court of Canada - today's 'Federal Court of Canada'.

Grand Trunk nominee: former US President William Taft.

And the Government nominee: ... who had just retired from Parliament ...

... lands a new job !

... lands a new job !

The Grand Trunk Railway stock was declared worthless

by the board ...

The stated rationale : Without public assistance, the Grand

Trunk Railway had no earning potential in

the foreseeable future ... because all of its earnings would have to be

directed to paying down the Grand Trunk Pacific's construction debt.

Dare to compare! :

Canadian Northern Railway stock valuation metrics ...

Drayton-Acworth assessed the value of the physical line and other assets ... not its future earnings potential in a high growth area of the Prairies.

Grand Trunk Railway stock valuation metrics ...

The Grand Trunk Arbitration Board assessed the GTR by its future earnings potential and its inability to pay down GTP debt ... not the value of the physical line and other assets.

Prime Minister Arthur Meighen

Prime Minister Arthur Meighen